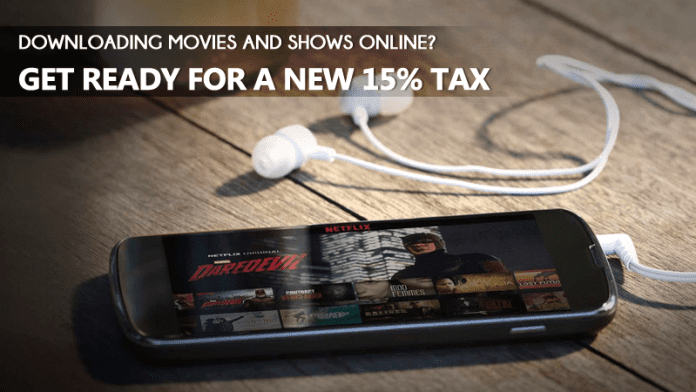

India government has decided to charge additional 15% service tax on online content downloads and subscriptions from foreign sites.

Get Ready To Pay 15% Service Tax On Online Downloads

Those days are already gone when internet users used to download their favorite movies, Games other files through the torrent because almost every popular torrent site are banned. We all have also seen the overnight ban on Rs 500 and Rs 1,000 currency notes. If that thing hasn’t stunned you yet then get ready for another surprise move by the Indian government.

If you are among those who downloads music, movies, e-books or even other services from overseas service providers then get ready to pay more. From December 1st, a new service tax component of 15% will be added to your bill.

Domestic suppliers that let you download movies in India are said to already incur 15% additional service tax. However, until now the 15% tax wouldn’t apply to an overseas supplier if the customer is an individual, government local body or government agency based in India.

The overseas suppliers can only acquire this service tax for business-to-business (B2B) transactions where the recipient is from India. There were also some exemptions available for Business-to-business transactions in case the supply is related to information databases, like the subscription for international tax journals.

Now, the Central Board of Excise and Customs (CBEC) has- through four separate but interlinked notifications dated November 9 for “Place Of Provisions of Service Rules” for “Online information and database access or retrieval services” that can impact your bill.

Therefore, from December 1st the place of provision of a service will be the recipient’s service location. Chartered accountant and indirect tax expert Sunil Gabhawalla told economic times “Hence, say, all downloads in India will be subject to service tax. The amendments impact overseas companies providing various services like advertisements, web subscriptions, cloud hosting, music, e-books, and gaming, to name a few. These services provided to governments and individuals were earlier not subject to service tax. They now become taxable and the overseas service provider or any intermediary or authorized representative will need to register in India and pay the service tax”

He also said, “Since the overseas service provider is likely to collect this tax from the end user who downloads these services, it will increase the cost for the consumer.”

When the new service tax component comes into play, the definition of “online information and database access or retrieval services” also changes. Sunil Gabhawalla added “Delivery is mediated by information technology over the internet or an electronic network and the nature of which renders their supply essentially automated and involving minimal human intervention, and impossible to ensure in the absence of information technology. The definition is very extensive. Its scope has widely increased by including cloud services, online gaming, and data storage”

So, if you are among those who purchased cloud services like OneDrive, Dropbox, Google Drive or even purchased software, movies, music from Amazon, Apple’s iTunes then be ready for the 15% tax that will be added to your bill.

So, what you think about this? Share your thoughts in the comment box below.